As of my knowledge cutoff date of September 2021, here are some key statistics for Dixon Technologies Share Price, an Indian company listed on the National Stock Exchange of India:

- Dixon Technologies’ stock symbol on the NSE is DIXON.

- The company’s market capitalization was around INR 22,000 crore (approximately USD 3 billion).

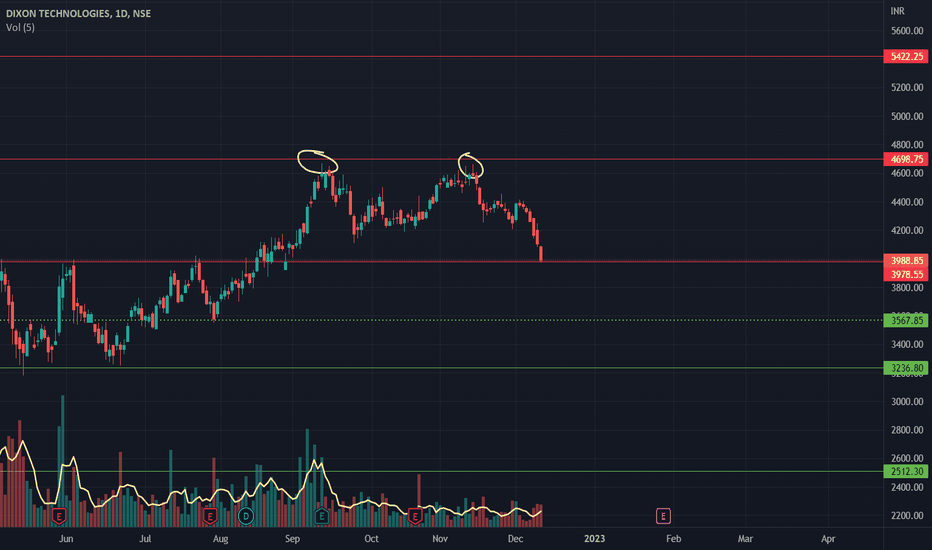

- Dixon Technologies’ stock price was around INR 4,600 per share.

- The 52-week high for Dixon Technologies’ stock was INR 5,289.50, while the 52-week low as INR 2,316.

- Dixon Technologies had a price-to-earnings (P/E) ratio of around 65, indicating a relatively high valuation compared to earnings.

- The company had a return on equity (ROE) of around 29%, indicating a strong performance relative to shareholder equity.

- Dixon Technologies had a dividend yield of around 0.23%, indicating a relatively low dividend payout compared to its stock price.

It’s important to note that these statistics are subject to change over time and may not reflect the current state of the company’s stock price or financial performance. It’s always a good idea to consult with a financial advisor or do additional research before making any investment decisions.

About Dixon Tech

Dixon Technologies Share Price is an Indian electronics manufacturing services (EMS) company that provides end-to-end solutions to original equipment manufacturers (OEMs) in the consumer electronics, home appliances, lighting, mobile phones, and security systems sectors. The company was founded in 1993 and is headquartered in Noida, Uttar Pradesh, India.

Dixon Technologies offers a range of services to its clients, including product design and development, sourcing and supply chain management, manufacturing, testing and quality control, and after-sales services. The company has eight manufacturing facilities located across India, with a total production capacity of over 20 million units per year.

In addition to its EMS services, Dixon Technologies has also diversified into the lighting, home appliances, and security systems markets. The company sells its own brand of products in these sectors under the brands Dixon, Zebronics, and Flipkart Smartbuy.

Dixon Technologies has been recognized for its contribution to the Indian manufacturing sector, receiving the National Award for Quality Products from the President of India in 2019. The company has also been listed on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) since 2017.

Dixon Technologies (India) Investment Ratings

Dixon Technologies Share Price (India) Ltd. is one of India’s leading technology manufacturing companies with a long-standing reputation for delivering quality products and services. In recent years, the company has been expanding its presence in the Indian market through investments in various sectors, including electronic equipment manufacturing and consumer durables. As such, investors have taken note of Dixon Technologies’ strong financial performance and investment prospects.

Recent ratings assigned to Dixon Technologies by leading independent research firms have been largely positive. Credit rating agency CRISIL recently upgraded their rating on Dixon Technologies from BB+ to A-, citing the company’s solid financials and ability to service debt obligations as factors influencing their decision. This upgrade reflects an improved outlook on the company’s financial stability and future growth potential in the electronics sector.

Dixon Tech share price insights

Dixon Tech, one of the biggest technology companies in the world, has seen its stock prices soar over the past few months. The company’s share price is up nearly 20 percent since May, making Dixon Tech one of the best-performing stocks on the market today. Despite a challenging economic landscape and uncertain future, investors remain bullish about Dixon Tech’s prospects for growth in the near term.

Analysts attribute this strong performance to several factors. First, Dixon Tech has recently launched several innovative products that have been well-received by consumers and industry experts alike. Additionally, its customer base continues to grow as new customers flock to their cutting-edge offerings. Finally, analysts speculate that many investors are betting that Dixon Tech will be able to capitalize on post-pandemic economic recovery with its wide range of products and services.

Dixon Tech News & Analysis

Dixon Technologies Share Price has been a leader in the technology industry for over 40 years, providing innovative solutions and cutting-edge products to its clients. From their highly praised customer service to their expansive product line, Dixon Tech is committed to meeting the needs of the ever-changing digital world.

This news and analysis section will provide up-to-date information on all things related to Dixon Tech. Here you can find out about new product releases, and upcoming events in which Dixon Tech will be participating, or read expert analyses from industry leaders as they discuss the future of technology with Dixon Tech at the forefront. Additionally, readers can explore recent press releases from the company and get an inside look at what’s happening behind the scenes of this leading tech giant.

Read Also…SafeSearch

Dixon Technologies (India) MF Shareholding

Dixon Technologies (India) Limited is a leading global diversified electronics manufacturing company. It has been in business since 1992 and provides integrated engineering solutions to its customers across the world. Recently, Dixon Technologies (India) Ltd has increased its total mutual fund shareholding to 9.86%, thereby increasing its stake in the company by 0.25%.

The mutual fund holding was steadily increasing ever since the quarter ending September 30th 2019 when it held 8.32% of total equity shares of Dixon Technology (India) Ltd. As per the BSE filings, Aditya Birla Sun Life Tax Relief 96 Mutual Fund holds 6.90%, SBI Small Cap Fund holds 3% and ICICI Prudential Focused Blue Chip Equity Fund holds 0.96%.

MF Ownership

MF ownership is a relatively new concept in the business world, but it has been gaining traction as an attractive option for companies looking to increase their market presence. Through MF ownership, companies are able to diversify their portfolios and share the risks associated with owning multiple entities. This type of ownership can be beneficial for both small businesses that want to expand and larger corporations that need to manage multiple investments at once.

MF ownership allows owners to maintain control over their various entities while also creating opportunities for businesses of all sizes by enabling them to spread out risk, access capital, and reduce costs associated with running multiple operations. With this structure, companies have more flexibility in terms of how they operate and can make decisions based on what is best for all divisions instead of just one.

Read Also…NASCAR Cup Series schedule

Dixon Technologies (India) Forecasts

Dixon Technologies (India) Ltd, a manufacturer of consumer durables, has announced their latest forecasts for the upcoming fiscal year. The company is expecting sales to grow by about 20%, fueled by expanding demand for consumer electronics and home appliances. As the leading provider of electronic products in India, Dixon Technologies is well-positioned to take advantage of this growth opportunity.

The company also anticipates an increase in gross profits driven mainly by higher product prices and increased efficiency measures implemented in its factories. In addition, Dixon Technologies Share Price expects a lower tax burden due to recent changes in government regulations that allow more deductions on investments made into research and development initiatives. With these factors combined, the company believes that it can achieve greater growth potential and boost its bottom line this coming year.